The App's Story

The Japan Analytics App provides comprehensive chart-based analysis of all listed Japanese companies. The App is designed to help investors evaluate the quality of Japanese companies and help them identify mispriced stocks.

The App has been developed by a team of database specialists, graphic UI designers and investment professionals and breaks new ground in the presentation of accounting data. We believe that accounting data is the best starting point for corporate analysis and valuation and that such data should be made more accessible and user-friendly.

What follows is the story of how the Japan Analytics App was conceived and covers some of the key ideas that drove its development over the last two years.

The Analog Years

Many things have changed in the Japanese equity market over the last thirty years. Access to fundamental data on companies in a readily accessible and affordable format has, however, not changed significantly since this analyst first purchased a 会社四季報 (Japan Company Handbook) in 1982.

First published in 1936 by Toyo Keizai, and later joined by the Nikkei’s 会社情報 in 1985, these quarterly tomes were the ‘bibles’ of the trade. Paired with a QUICK Video-I market terminal, you were a Japanese equity market pro.

The QUICK machine is long gone and the Nikkei has recently stopped publishing the 会社情報, but the venerable 四季報 soldiers on, now spawning an online version, iOS Apps and a large-print version for its long-sighted older readers.

The half-page-per-company format limits the amount of fundamental data that can be presented, nevertheless, the 四季報 remains the best source for short business descriptions of listed companies and also contains the well-followed Toyo Keizai forecasts. Despite its limitations, bulk and weight, the it remains an indispensable tool for every Japan equity investor. A copy of the English language version has even been spotted on a certain office desk in Omaha, Nebraska.

The Digital Age and Market Data Oligopolies

At the other extreme, services such as Bloomberg, Thomson Reuters, Nikkei Needs and also Toyo Keizai provide industrial quantities of market and fundamental data at institutional prices. Many websites in Japan provide financial data targeted at retail investors, but they offer only price, volume and summary accounting data and only in Japanese. The institutional data vendors platforms are focused primarily on news and tick-by-tick market data. The accessibility and presentation of fundamental data plays second fiddle. Clients are required to do most of the heavy lifting themselves having to import and format data in Excel-based earnings and valuation models.

Imperfect Analyst Models

Most professional analysts' and fund managers’ models only use a fraction of the data they pay so dearly to access. There is also significant variation in quality and accuracy of analytical output and the assumptions behind the models that generate it, even within the same organization. Apples-to-apples comparison of companies even in similar lines of business is something of a lottery if the data and model are not sourced from the same analyst.

Collectively, the financial sector in Japan spends more than US$100m a year on the creation and distribution of financial models of Japanese listed companies. Much of this work consists of manual entry of historical data which is duplicated scores of times for the most-covered companies. The industry has been slow to automate the research process and attempts to do so have been met with resistance from analysts who are content with the 'make-work' status quo.

The implementation of the MiFID II rules and the un-bundling of research in Europe in 2018 is likely to force a review of research processes globally as costs are brought in line with the reality of what the buy-side is willing to pay for research. We hope that the Japan Analytics App can demonstrate what can be achieved by automating analytical research models.

The Universe of the Uncovered

There are over 27,000 members of the Japan Securities Analysts’ Association and the Japan Investment Advisers Association member firms have 2,000 people engaged in investment management and research, and yet over 2,250 listed companies have no analyst coverage. MiFID II’s implementation may result in 'reductions in force' on the sell-side and a further concentration of coverage. Some smaller companies now pay for research to be written by commissioned research specialists, but the numbers are not yet significant. As a result, for around two-third of listed companies the only public sources of information are the company's own websites and their regulatory filings which are often only available in Japanese.

EDINET, TDnet & XBRL

Japan’s versions of the EDGAR database in the U.S. (the FSA’s EDINET and the TSE’s TDnet) have required XBRL reporting since 2008 and there are a number of free websites and twitter bots that aggregate and disseminate this information.

XBRL tagging should have provided an opportunity for standardization of reporting and the FSA prepared a list of around 2,500 ‘Group A’ line items to which, after many company complaints, were later added a further 2,000 ‘Group B’ items.

Companies were still given latitude to add their own ‘extension’ line-items. These ‘extensions’ now exceed 60,000 and make XBRL-based intra-company comparison frustrating. Further, many companies still use footnotes which are block-tagged as text rather than as numerical data in XBRL. The result is a very large funnel of unstructured electronic data which requires proprietary software and filtering technologies to be of any use.

The App Project

Two years ago, we decided to attempt to fill the gap between the quarterly company handbooks and the existing market data vendors’ product offerings. The goal was to provide users with more accessible analytical data than the latter at close to the price of the former.

Presenting up to 30,000 data points per company covering 28 years and 28 quarters suggested a mostly graphic user interface. Accessibility and portability suggested a mobile delivery platform and, with the recent advances in Apple’s chip technology, graphics and color rendering and the introduction of larger sizes, the Apple iPad was the obvious choice. The added security and privacy of iOS relative to a Web interface was an added attraction. The App will run on 9.7", 10.5" and 12.9" iPads with iOS 10 or 11. An iPhone version is under consideration.

The sections below provide more background on the methodology behind the key features of the App. For more detail on each of the modules together with App screenshots, please see the relevant module page.

Data Source

Our data source has to be robust, comprehensive, updated daily and cover periods before 2008. We also required the quarterly reporting format to be adjusted from the disclosed cumulative presentation into discreet three-month quarters to drive our quarterly cash flow statements.

Our content and analytics partner, PacificData http://www.pacificdata.co.jp/ , has more than 25 years of experience in providing financial solutions on Japanese companies and offers over 2,200 reported fundamental data items dating back to 1984 including quarterly adjusted data from 1998. PacificData placed no restriction on the amount and type of data that could be presented in graphic format, permitting us to offer a comprehensive overview of every listed company’s financial condition – up to 178 fundamental and market data charts per company. All data points are updated daily from primary sources, including all quarterly, interim and annual corporate disclosures.

Sectors & Peer Groups

The Tokyo Stock Exchange (TSE) first classified listed companies into 33 sectors over 50 years ago and in 2002 consolidated the list into 17 sectors, although the 33-sector breakdown remains in use. Due to inertia and the costs of re-calibrating indices, we still have sectors such Pulp & Paper, Mining, Textiles & Apparels and Marine Transportation. There is also a large disparity in number of constituents between the smallest (7) and largest (396) TOPIX 33 sectors. Currently the TOPIX 17 sector IT, Services & Others has over 900 constituents - a quarter of the total number of listed companies. A reorganization is overdue, but the TSE is unlikely to take the initiative .

SIC and GICS classifications have been applied to Japanese companies by MSCI and others, but these classifications have failed to resonate with local market participants, being too broad at the first level and lacking local specificity at lower levels. This is one reason for the persistence of the current, but now outdated, TSE sectors. As cross-company comparison is a key feature of the App, we have presumed to reinvent the wheel.

Our starting point is the company's disclosed business segment data for revenue and operating income. Based on the largest current business segments, companies have been allocated to 30 Sectors and 328 Peer Groups or 'sub-sectors'. Sectors are a blend of traditional local market sectors and GICS. Currently the smallest Sector is Utilities at 21 constituents and the largest is Wholesale at 281. To reflect the more diversified business model of some listed companies, a 'Multi-Industry' Sector has been included which currently has 23 constituents.

Peer Groups classifications also acknowledge local equity market conventions and analytical practices. For example, auto-parts companies are grouped by end-customer and Aeon Group food retailers form their own sub-group in the retail Sector. Currently Peer Groups range in size from 1 (Tobacco) to 51 (Internet Software & Services).

The creation of Peer Groups was the key to the organization of the App’s Company Analysis modules. Companies are always loaded together with their peers to allow for easy peer-to-peer comparison. The Heatmaps Module is arranged by nesting Stocks into Peer Groups which are in turn nested into Sectors. Every listed company's heatmap can be reached in just two taps.

We acknowledge that this is a first attempt at bringing the classification of Japanese listed equities up to date. Many market participants will, and should, challenge our assumptions. We welcome suggestions from any source but, most particularly, from the companies themselves. We seek to improve this effort thorough crowd-sourcing. Please send us any comments and suggestions using the Contact page.

Accounting Visualized™

The App’s Analysis Module uses charts to present up to 28 periods of data in formats that make trends and relationships easily understood. Data are presented in Annual, Quarterly or in rolling trailing twelve-month (TTM) formats. Every chart in the App can be accessed in no more than 3 taps and can be viewed as thumbnails without axes or titles, as standard charts or zoomed to full-screen. As companies are presented in the App together with all of their Peers, peer-to-peer comparison requires only a swipe or touch in either 12-chart or single chart view.

The most common chart format combines stacked columns of fixed values with corresponding ratios in line format, but the App also uses cumulative line charts for normally volatile data series such as the components of cash flow to highlight the evolution of trends in the data. Scatter plots are also used to show the relationship between PER and PBR over time.

Numbers in the charts are kept to a minimum but include forecast operating margin, net margin and dividend, annual and TTM core returns, TTM and forecast upside/downside and PER and current PBR, as well as the market-implied growth rates and annual expected returns. In addition, the Comparison Module provides 12 key data points in one table for each member of a Peer Group.

Accounting Presentation

Accounting data are normally presented using a temporal framework in the Balance Sheet to distinguish between current and longer-term assets and liabilities. Net Income is normally presented as the bottom line of the Income Statement and the statement of cash flows is not fully reconcilable.

Proposals have been made to various local and international Accounting Standards Boards to reformulate financial statements in ways that better reflect how businesses operate and provide a better framework for valuation analysis. After more than ten years of discussion, there has been little progress.

In Japan, there has also been a trend towards implementing IFRS accounting, although a version modified to suit Japanese preferences, JMIS, has been introduced from this fiscal year. At present, there are five accounting standards being applied: JGAAP-Parent, JGAAP-Consolidated, SEC, IFRS and now JMIS. Variances in accounting treatment between these standards can have a bearing on valuation. For example, Accumulated Other Comprehensive Income is not included in Shareholders’ Equity under JGAAP, but is included under IFRS and therefore impacts return on equity calculations.

The presentation of accounts in the App follows the conventional approach only in the Income Statement sub-module. Otherwise, the Company Analysis module reflects many of the proposed reformulations which allows for a consistent presentation of accounting information over time, irrespective of the accounting standard followed in a particular period.

We have taken inspiration from the work of Professor Stephen H. Penman the George O. May Professor of Accounting at the Columbia Business School and Co-Director of the Center for Excellence in Accounting and Security Analysis (CEASA) which is based at the school. Professor Penman is the author of the business school textbook Financial Statement Analysis and Security Valuation, for which he received a Wildman Medal Award. Professor Penman has also written the more accessible Accounting for Value. Both of these works are highly recommended and at least the latter should be read be anyone using the Japan Analytics App.

(Neither Professor Penman nor the CEASA have any involvement with PD Analytics or the Japan Analytics App.)

The key features of the reformulated accounts presentation are:-

- Operating income and expenses and operating assets and liabilities are clearly distinguished from financial income and expenses and financial assets and liabilities. This separates the operating activities that add value to the business from the financing activities which, with a few exceptions, do not.

- The bottom line in the income statement is comprehensive income to common equity. All changes in the balance sheet are thus fully reflected in the income statement. Other comprehensive income items are grouped and reported together with operating or non-operating items.

- Operating income is presented net of tax as "NOPAT" and consists of core operating income after tax and other operating income after tax. The former is considered ‘sustainable’ and is preferred to the more transitory items that comprise other operating income. Core NOPAT forms the basis for our return calculations and residual income valuation.

- Other than the allocation of taxes between operating and financing activities and the quarterly adjustments to the income statement, each item in the financial statements is as originally disclosed. No adjustments are made for goodwill, research expenses, lease obligations or rental expenses.

- Cash flows are divided into four categories: operating, investing, financing and shareholder cash flows. Operating and investing cash flows sum to free cash flow and free cash flow plus financing and shareholder cash flows plus minorities and adjustments sum to change in cash. This presentation better reflects a normal business cycle where value is generated from trading with customers and suppliers and is then disbursed to the financial activities and to shareholders. Investing cash flow includes changes in fixed assets and inventories. Changes in investment assets are included in financing cash flow.

- The income statement, balance sheet and cash flow statements fully articulate in a ‘clean-surplus’ relationship and apple-to-apples comparisons can be made and ratios derived. Free cash flow, for example, is a simple subtraction: NOPAT less the change in net operating assets/liabilities.

Returns

Reconciling the accounts to separate operating and financial activities also helps simplify the decomposition of returns beyond Return on Equity.

In the App's Company Analysis Module, “RoE” is defined as the comprehensive income return to common equity (ROCE).

ROCE can be broken down into an operating component, the return on net operating assets (RNOA) and a financing component. The latter is determined by the amount of financial leverage (FLEV) multiplied by the spread of RNOA over the cost of borrowing (F-SPREAD).

ROCE = RNOA + (FLEV * F-SPREAD) + Adjustments*

*Adjustments cover the effect of any minorities, warrants and preference shares.

RNOA can be further broken down into a return on operating assets (ROOA) and the effect the operating leverage provided by suppliers. The leverage effect is determined by the amount of operating leverage which is operating liabilities/net operating assets (OLEV) multiplied by the spread of ROOA over the cost of borrowing (O-SPREAD).

RNOA = ROOA + (OLEV * O-SPREAD)

A final distinction can be made between sustainable or ‘Core’ operating income and ‘other’ more transitory items including operating other comprehensive income items.

RNOA = Core RNOA + Other RNOA

Core RNOA is a key measure of operating profitability for non-financial companies and is the final and most important chart in the Returns sub-module in Company Analysis.

Valuation

Valuation for most non-professional market participants rarely goes beyond PER and PBR. These ratios are included in the App’s Valuation charts in both unlevered and levered formats and as data points for the trailing twelve-months and last balance sheet date in the Comparison Module. PER/PBR times series scatter plots are also shown to illustrate the dynamic between the two ratios.

The Analysis Module also includes a simple ‘Residual Income’ valuation model that provides a snapshot valuation for the company for every reported period. The model valuation can then be compared with the actual market value at that time or currently to provide both an upside/downside assuming no-growth and, in certain cases, the market implied growth rate.

Residual Income models rely on available historic accrual accounting data and do not require the forecasting of cash flows or that future cash flows be positive. The 'anchor' value of a business is mostly comprised of current book value, rather than the more nebulous present value of some large terminal amount.

The version of the Residual Income model used in the App is very simple, being single-stage and assumes no growth. The model is anchored on the current book value attributable to common shareholders. A charge for the company’s use of its net operating assets (NOA) is then applied at a fixed rate of 6%. A required return of 6% is debatable, but can be supported by the empirical evidence of long-run returns on industrial assets in major economies.

A company’s required return on NOA for any period is therefore 6% of the previous period’s net operating assets. This required return is then subtracted from the company’s core operating income after tax and minorities with the balance being the ‘residual income’ for the period.

RI = Core NOPAT - (NOA Y-1 * 0.06)

No account is taken of, or value placed on, any returns that may be generated from net financial assets/liabilities (NFA/L). A final assumption is that the current level of residual income is sustainable and that its present value can be represented by the capitalizing the current value at 6% (multiplying by 16.67).

The no-growth valuation (NGV) for each period is the sum of book value and the capitalized residual income less any Minorities, Warrants and Preference Shares (MWP).

NGV = NOA + NFA/L + (RI/0.06) - MWP

Any gap between the no-growth valuation and the market’s valuation of the business can be analyzed as either:-

- potential ‘upside’ or ‘downside’ to the stock if the current level of residual income is sustained and does not grow, or

- the future growth rate (negative or positive) for residual income that is implied by the market price.

We would suggest that it is from here that the real work of the equity analyst should begin with the focus being on determining if any valuation gap or implied growth rate is justified by the current prospects for the business. Our App can only lead the analyst to the water's edge.

The valuation model is run for every accounting period and is compared with the market capitalization and dividends at that time. For historical periods, there is a timing mismatch as the periods’ results are not known until several weeks after the period end. The charts therefore include the no-growth valuation calculated based on the most recent forecast before the fiscal period end. This also serves to illustrate the impact that the company’s forecasting record can have on market valuation.

Scoring

Many web-based investment services provide scoring systems that attempt to measure variables such as ‘Quality’, ‘Value’ and ‘Momentum’. Some even offer one all-purpose composite score in order to simplify investment decisions.

The scores themselves are normally combinations of several widely-used or academically-favored factors, not all of which have been found to be effective in all markets or at all times. While the results can be impressive at times, experience suggests caution when using 'magic formulas', especially when dealing with outliers.

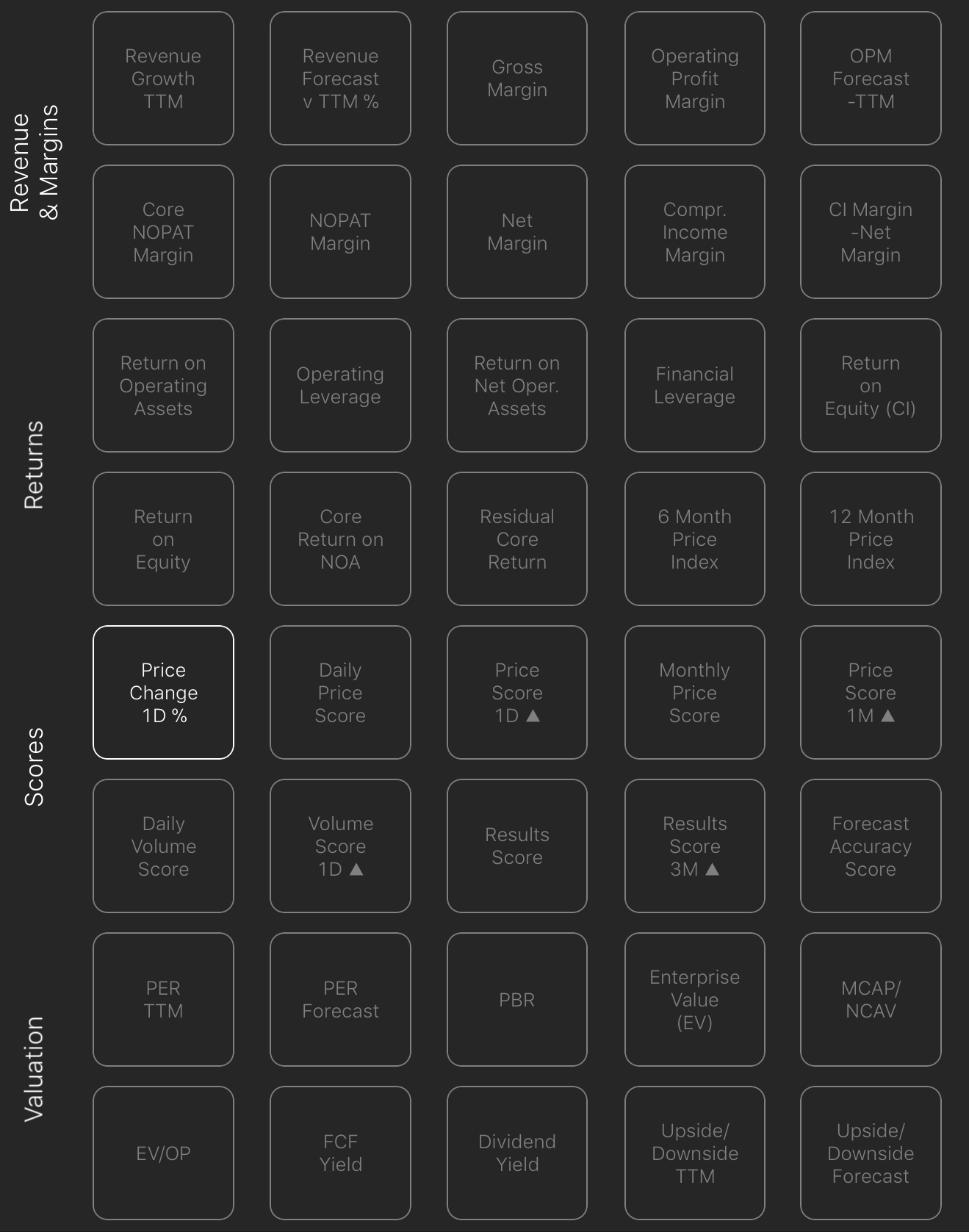

The Scores provided in the App are limited to more tangible single factors such as price relative to market, volume relative to shares issued, earnings momentum and earnings forecasts compared with actual results. When combined with the 30 additional margin, return and valuation factors in our Ranking and Screening modules, this approach offers greater flexibility in ranking and screening companies and complements our preferred valuation methodology.

The Japan Analytics App features the following Scores:-

Market Data > Price Score & Volume Score (examples below)

Results > Results Score

Revisions > Revisions Score

Forecasts > Forecast Accuracy Score

Forecasts and Segment Data

Much of the information that is disclosed by Japanese companies is ignored if it not current, but this data can provide insights into company behavior and history that adds value to the analytical process. Forecast and Segment Data are two examples.

The Forecast Module uses data from PacificData's Forecast database which contains a history of every initial forecast and forecast revision made by all listed companies over the last ten years. Although companies are encouraged to provide forecasts of Revenue, Operating Income, Recurring Income, Net Income, EPS and Dividends, not every company complies and some are selective in what they choose to forecast.

Historical forecast data are used to analyze the timing and frequency previous forecasts and their variance from the actual results. From this data we also derive the Japan Analytics' Forecast Accuracy Score.

Note that the Forecast Accuracy Score is not calculated for companies that have a short history of forecasts and those that have made no forecasts for two years. We also do not score some trading companies die to inconsistent definitions of Revenue.

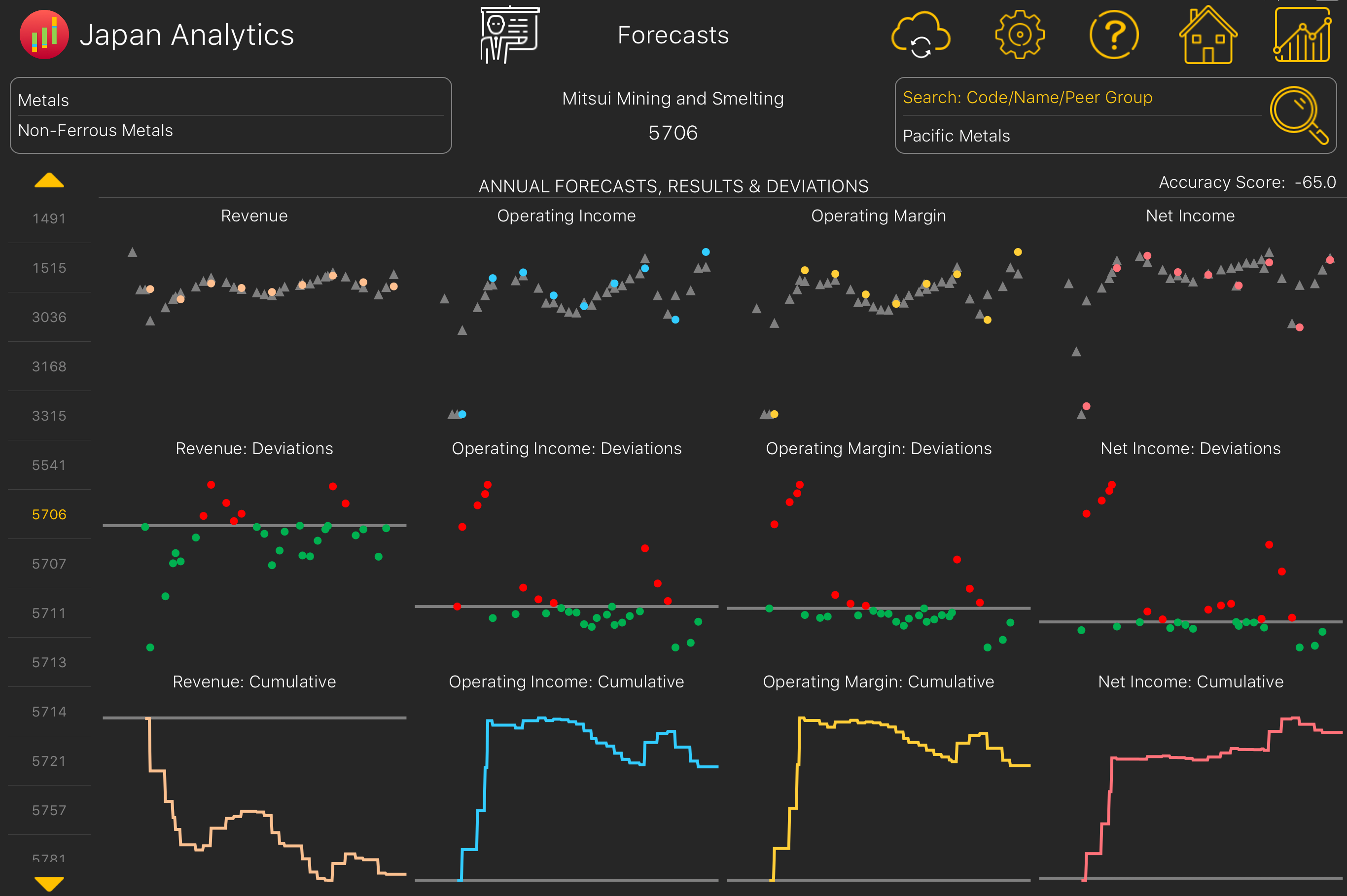

Our presentation is designed to highlight variances in each forecast as well as cumulatively. We also chart Operating Margin rather than Recurring Income as it is a key component of the Accuracy Score. In the example below, Mitsui Mining & Smelting (5706) has revised its initial forecast almost every quarter and although its record has improved over the last 10 years, large deviations at the start of this decade result in a Forecast Accuracy Score of -65.

We believe that this level of detailed data on forecast history is not currently available from any other source.

Business and Geographic segment data has been disclosed by most companies for many years and offers similar behavioral insights. With no fixed requirements, companies have chosen to be highly selective in their disclosure particularly concerning operating income citing competitive pressures for being less than forthcoming. There is also a tendency to eliminate or merge loss-making segments and there are all to frequent business reorganizations designed more to conceal than reveal. The Japan Analytics Segment Data Module adopts a 'warts-and-all' approach but, in the interests of clarity, we only show 15 business and 10 geographic segments. This flatters companies such as NEC and Marubeni which have had more than 30 business segments each in the last ten years. The former is shown below after a 50% pruning.

In addition to our timeline disclosure in Segments, the App also introduces PacificData's manual translations into English of the over 10,000 business segments that have been disclosed to date by listed companies in Japan. We believe that this information is not currently available from any other source.

Results & Revisions

'Earnings season' is the busiest time of each quarter for professional analysts. At the 'peak' over 550 companies can report earnings and in mid-May as many initial forecasts for the current year are also released. Processing that amount of data is a challenge for most data vendors. For investors, sorting winners from losers is very time-consuming and frustrating. In addition, Japanese companies' preference for cumulative reporting of year-to-date numbers makes it difficult to compare quarter-on-quarter and year-on-year trailing twelve-month changes.

The Japan Analytics Results Module and Revisions Module both aim to simplify the daily task of analyzing company filings.

Rather than repeat the company's disclosed numbers, the Results Module provides for Revenue, Operating Income and Net Income: -

- the latest 3 month quarter year-on-year percentage change

- the trailing twelve-month (TTM) results in ¥b

- the TTM year-on-year percentage change

In addition each result is 'scored' on a scale of +30 to -30. The scoring covers the most recent eight reported quarters Revenue and Operating Income and measures both results and results momentum and should, in theory, have a reasonable degree of correlation with the market's reaction to the announcement. As a secondary indicator, we also include the change from the previous Results Score.

For 'heavy' results days, filters are provided for Period, cap range, score and change in score and all changes and scores can be sorted.

We believe this is the most efficient earnings results tool currently available.

The Revisions Module provides data for Annual and Interim Revenue, Operating Income and Net Income Initial Forecasts and Revisions in one table which can be sorted and filtered. In addition to the new forecast data and the percentage change from the previous forecast, the difference between the new forecast and the trailing twelve-months (TTM) results is also shown.

As with Results, each revision is 'scored' on a scale of -20 to 20, the scoring being based on the changes relative to any the previous forecast and the TTM results. Filtering is by period and type. market cap range, change v. TTM and Score. Sorting is by change v. TTM.

We hope that our Results and Revisions Modules are of some help to investors in tracking corporate earnings updates.

Ranking & Screening

Every data analysis product this analyst has used in the last 30 years has featured a ranking and screening tool and this App is no exception. We have tried to improve on the conventional offerings by adding more factors and by reducing the number of steps required to reach the end result.

Unless data are not available, both modules use only the latest training twelve-month (TTM) data which are updated daily. The Ranking Module is limited to only 40 factors covering Revenues, Margins, Returns, Scores and Valuation. The focus is on the key drivers of past performance and those which may have some bearing on future returns. Our factor list is not cast in stone and we welcome any suggestions for deletions and additions (with the possible exception of EV/EBITDA).

The Screening Module adds 70 demographic filters to the 40 factors from the Ranking Module and applies 5 ranges to the factors - top quartile, top half, bottom half, bottom quartile and all. Having used a multitude of screening tools over the years, we have designed the module for simplicity and speed. The average screening should take no more than a few minutes to complete and the result a matter of seconds to deliver. Screens can be saved for reuse and can be synchronized across multiple devices using iCloud Drive.

Our companion Blog and Twitter feeds will highlight our favored screens from time to time, but, as an example, the table below shows the result of a screen of 'net-net' stocks with positive residual core returns, positive result scores and substantial upside to their no-growth value based on both TTM and forecast operating income.

Work in Progress

It has been a fun two years, but we consider this to be just the start of the journey. We welcome any suggestions as to how to improve our product as well as any corrections. Please email us using the Contact page.